Request Customized Document

Request Customized Document Delhi, the proud capital of our country and one of the first cities to be declared as a Metro. Apart from being the centre of the most important Govt. buildings, the city is also famous for its rich past and its share of historical monuments. That combined with the pleasant climate and the buzz of activity, makes Delhi a popular place to move to for job opportunities.

To draft the rental agreement, you need to do the following

Stamp Duty – It is the duty paid to the Government whenever an agreement or transaction is created. Stamp Duty is calculated on the basis of the value of the transaction. It is paid to the Government by purchasing Stamp paper of due value.

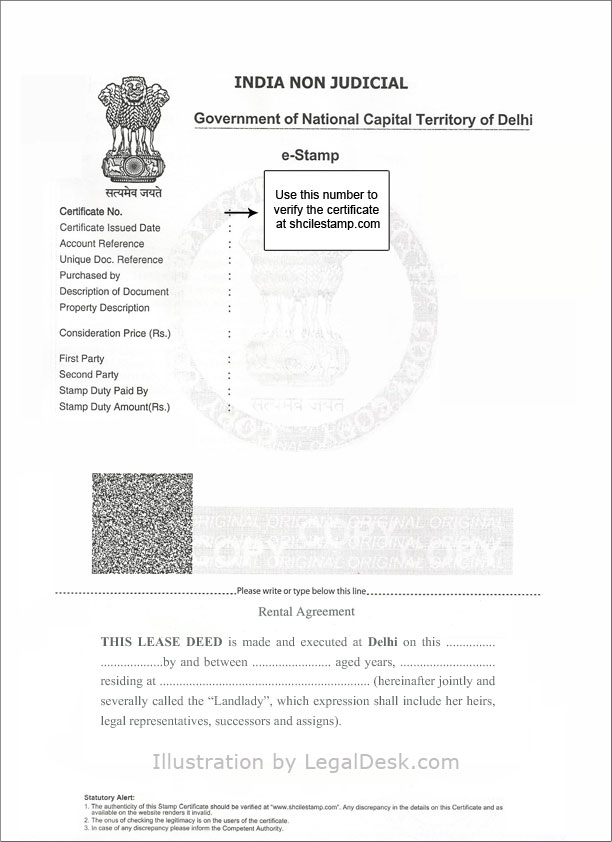

There are two kinds of Stamp papers: the traditional Stamp paper and the e-Stamp paper.

Delhi has dropped the conventional stamp paper systems and shifted entirely to the e-Stamping system operated by Stock Holding Corporation of India (SHCIL). If a person needs Stamp paper he can approach the e-Stamping vendors and purchase it from them. You need to provide your name and the purpose in the application form. The conventional Stamp papers are no longer used in Delhi.

Registration of the lease/rental deed in Delhi has certain procedure that needs to be followed by all.

Charges related to registration:

Documents to be presented by the Owner for registration:

Documents to be presented by the Tenant for registration:

Some folks opt for Notarisation of the rental agreements but Notarisation is not registration. Hence a Notarised rental deed is never a replacement for a registered deed. Courts do not accept them as evidence in case of disputes. Even if the deed is Notarised, you still need to register it.

The reason given for Notarisation by many Stamp Vendors is that the unregistered document will be considered a legal address proof with Notary seal, but there is no legislation to state so. Notary seal simply states that you have attested it in front of a Notary Public.

Another popular mode of renting is on a long term lease for a certain number of years. There is no monthly rent payable by the tenant. At the end of the term of lease the owner has to return the lease amount to the tenant. Electricity, water and maintenance charges have to be paid regularly by the tenant. There is no interest paid on the lease amount.

The procedure of registration and Stamp Duty are the same as residential properties for renting of the Commercial properties also.

The procedure for registering a commercial lease and the Stamp Duty associated with it are similar to that for rental agreements.

Delhi has many popular residential areas like Mayur Vihar, Dwarka, Chanakya Puri, Noida, Civil Lines etc so houses are very much in demand. While creating the rental agreement, it is very important to include some vital clauses in the agreement. Some important clauses that should be included in the rental or lease deed are given below:

If these clauses are included there will be no unnecessary disputes between the landlord and tenant in future.

Finding a proper place to rent is a tiresome, energy and time consuming task. In Delhi, the rent and lease are controlled by The Delhi Rent Control Act, 1958. The person taking the house for rent is termed the tenant or lessee, and the person letting it out for rent is termed the landlord or owner or lessor. Before taking the house or flat on rent make sure of these following details:

Deposit – In Delhi, the usual trend is to collect 2 to 3 months worth of rent as security deposit. This deposit is to be refunded by the owner to the tenant at the time of the tenant vacating the premises. No interest is paid on deposit amount.

Token Advance – At the time of blocking the house for rent, the tenant sometimes pays a small token advance to the owner. This is to prevent the owner entertaining other potential tenants. The token advance blocks the property until such time as either party backs out. Once the token advance is given, it is understood that both parties are ready to enter into the agreement. But if either of the party backs out from proceeding further, then that party has to make good the loss to the other party.

It is often a practice among people to create rental agreements on Stamp paper of minimum values like Rs.20/- or 50/- or 100/- etc. This is to save money on paying the actual Stamp Duty charges prescribed by the Government. The difference in the Government charges and the minimum charges is usually very small. As long as there is no legal dispute between the owner and the tenant things go well. Now let us see an example:

Ashok is the owner of a 2 bedroom house. He lets it out on monthly rent of Rs. 8000/- to Mahesh for a period of 11 months. The security deposit is Rs.50000/-.They make a rental agreement on a 50 rupees Stamp paper. Things go well till 5 months. Mahesh pays rent till 5 months after which he stops paying the rent and also refuses to move out. Ashok immediately approaches the Court. The Court impounds the agreement for deficit Stamp Duty paid and imposes the fine of up to 10 times the Stamp Duty to be paid. So what will be the penalty Ashok has to pay? Let us calculate.

8000×11 = 88000 x 2% = Rs. 1760 + 100 = Rs.1860 x 10 = Rs.18600/-

Hence Ashok will have to pay Rs. 18600/- to the Court as fine for non payment of Stamp Duty.

But if Ashok has initially made the agreement by paying the proper Stamp Duty he would have had to pay only Rs. 1860/- Hence it is always recommended that you pay the appropriate Stamp Duty and be relaxed.

An unregistered rental deed is never an evidence in the Courts. It is just a collateral evidence and cannot be used to prove one’s claims. Hence, Registering rental agreement is very essential to be on the safer side.

Let us look at this example:

Amit let out his flat for rent to Vikas. He made the agreement on Stamp paper of due value. But he did not register it at the Sub-Registrar office. The agreement was signed by both. For the first 4 months, Vikas paid the rent properly. the rent was fixed at Rs. 5000/-. After 4 months, Vikas stopped paying the rent. Amit approached the Court. Though his agreement was properly Stamp Duty paid, the Court refused to accept the deed as evidence. Vikas claimed that the rent was only 1500 and not 3500/- as claimed by Amit. He also refused to have signed the deed and completely denied making any agreement with the owner. Since the document was not registered, it could never be used as an evidence and for lack of evidence Amit had to lose the fight.

While this article explains the nitty gritty of rental agreement procedure, now you can make your agreement and get it delivered with Stamp paper. LegalDesk offers pre-drafted, ready to use, lawyer verified rental agreement. All you need to do is fill in your details and we will do the rest. We also offer the option to print your document on stamp paper and deliver it to an address of your choice. If you are looking for rental agreements for Noida and Gurgaon we have the them as well!