Rent Law 2025: What You Must Know Before Renting or Letting The Rent Law 2025 brings major reforms to...

The Stamp Duty Payment API can be used to buy stamp paper from LegalDesk.com by the intended users. If you are a startup or business owner dealing with making agreements on stamp papers, by using the Stamp Duty Payment API, you can automate the process of stamp paper acquisition, thus escaping out of all the hassles involved in manually importing the same.

Further, for those who are unaware of what a stamp paper is, let’s first understand the relevant terms.

For every legal document that is executed, as per the Indian Laws, it is mandatory to pay some tax to the Central/ State Government which is termed as ‘Stamp Duty’. For instance, transactions such as buying or renting a house, making a loan agreement, executing a power of attorney, gifting a property through gift deed, etc involve paying of stamp duty to the government. The amount of stamp duty to be paid for any transaction varies from state to state.

The different methods of paying stamp duty include-

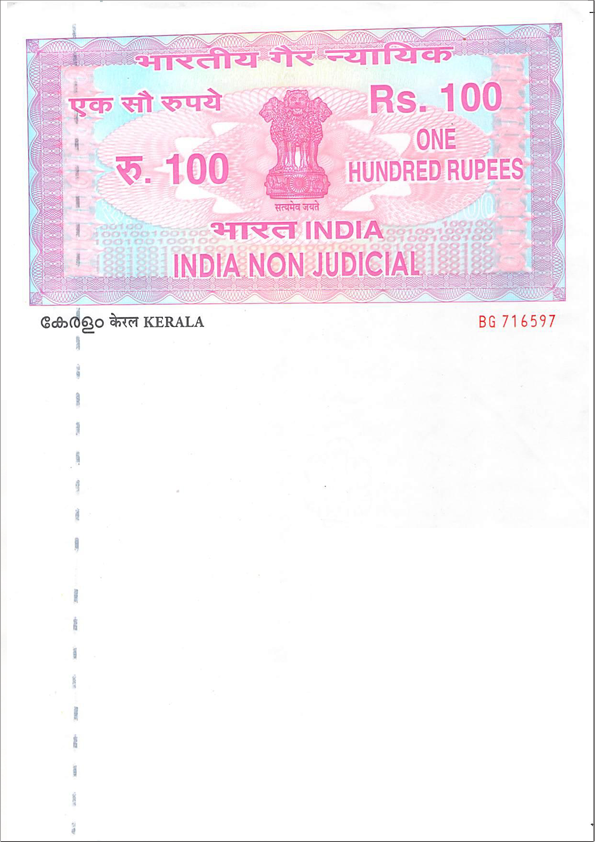

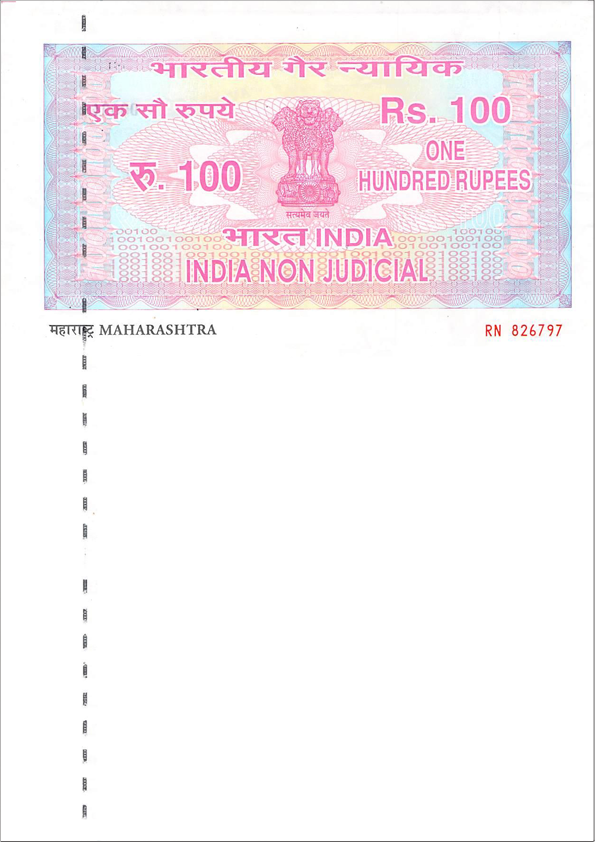

The most common way of paying stamp duty in India is through the purchase of Stamp papers, which are different in different states. The traditional stamp papers have to be purchased from licensed Stamp Vendors.

Usage of the traditional stamp papers is in place in states such as Andhra Pradesh, Telangana, Gujarat, Tamil Nadu, etc.

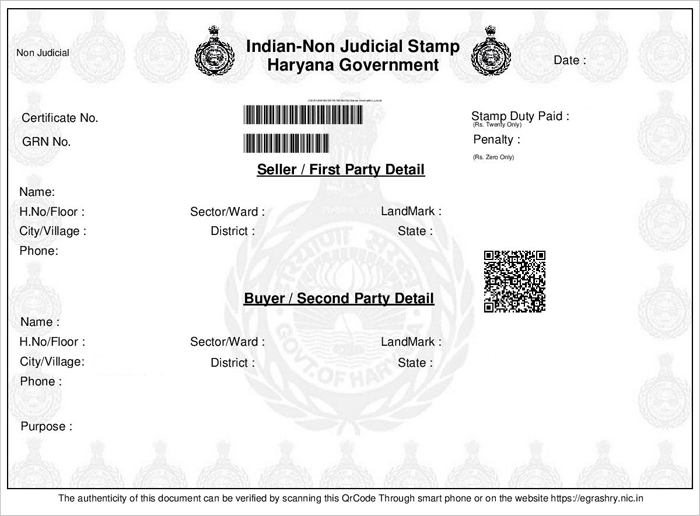

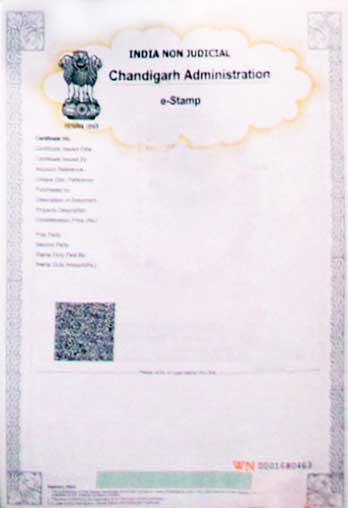

E-stamping is an electronic way of stamping documents and paying stamp duty to the government. To get an E-Stamp you will have to first provide details such as First Party Name & Second Party Name, Amount of Stamp duty, Stamp Duty paid by, Type of document, etc. The method of generating a stamp paper online is also referred to as e-Stamping.

e-Stamping has been introduced in 19 states across India, however, most of the states restrict the amount below which the e-stamp papers cannot be used for transactions. The states in which e-Stamping is extensively operational include Delhi, Karnataka, Haryana, Uttar Pradesh, Himachal Pradesh, etc.

The usage of e-stamp papers has certain advantages to that of traditional stamp papers which are as follows:

In this method, one has to submit an application at an authorized franking agency, sub-registrar office or a bank. The document for which the Stamp duty is being paid for has to be attached with the application and the agency/bank affixes a stamp on it indicating that the required duty has been paid.

eChallan is an online Government Receipts Accounting System (GRAS) associated with various departments generating revenue to the Government.

States including Maharashtra, Haryana and Himachal Pradesh among others have been providing this e-payment facility to the citizens. There is a catch however that most of the states are currently using this system for Compulsorily Registrable documents.

Users can pay various taxes and stamp duty by logging into the portal of their respective state governments. On successful payment, an eChallan will be generated which would be password protected. The eChallan includes a challan identification number (CIN), payment details and the bank name through which e-payment has been made.

With the Stamp Duty Payment API, you can buy stamp papers from LegalDesk.com, whenever required. The stamp paper service usually depends on the availability of stamp paper for the State chosen by the client or user. Once an order is placed and if the requisite stamp paper is available, the order will be processed immediately. On the other hand, if the stamp paper is not available, the message will be conveyed to the user. But as soon as the requisite stamp paper is available, it will be sent to the user.

To start using the Stamp Duty Payment API, click the button below and submit a request for the same following which, one of our development executives will call you to guide you through the further steps in availing the API.

Given below are some of the samples of non-judicial stamp papers including traditional stamp papers, eStamp papers and eChallan.