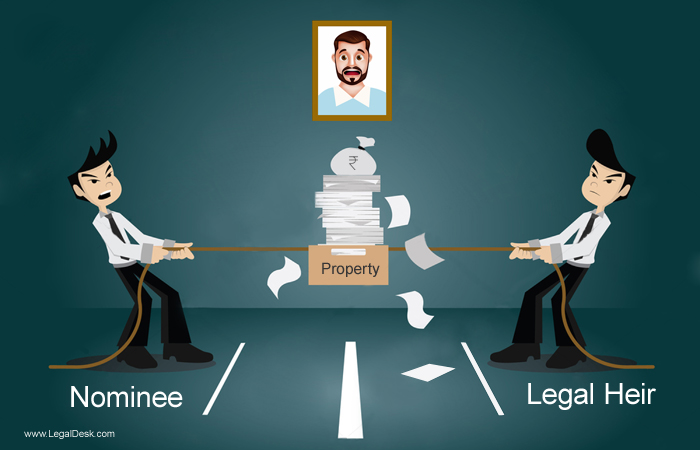

Are you unsure about who is going to inherit your assets after you meet your maker? You may have appointed nominees who are not your legal heirs while acquiring some of your assets. But your legal heirs might interfere claiming that those assets actually belong to them after your death. So, how do you ensure that those nominees are the ones who get what you leave behind for them?

Where there’s a ‘Will’, there’s a way! Yes. You read that right. The simple solution to this problem is to make a ‘Will’ (testament). After your death, your property is distributed based on your Will, in the absence of which, succession laws come into effect.

Who Is A Nominee?

A nominee is a person that you appoint to receive an asset or investment (or its value as promised prior) in the event of your death. A nominee may not necessarily be a legal heir or a relative. But be aware that nominee should be someone who you can rely on.

In case you have not appointed a nominee for any of your prior investments, or if the nominee you had appointed predeceases, then you can change the nominee any time by following certain procedure. The nominee holds the asset until your family members or dependants establish their claim on the same. But if you have made a Will stating otherwise, then it would discard all the nominations. Still, you should never skip nominating someone for every asset you buy.

Who Is A Legal Heir?

A legal heir is referred to an individual mentioned in the Will of a deceased person, who has an indefeasible right over the assets or investments of the deceased. Legal heir is entitled for most assets. If a Will is not made, then the assets of the deceased person gets shared according to succession laws. The classification of heirs and who gets how much is different in different succession laws.

| Who Are Governed? | By Which Law? |

| Hindus, Sikhs, Jains, Buddhists | Hindu Succession Act, 1956 |

| Parsis, Christians, Jews, Muslims (testate) | Indian Succession Act, 1925 |

| Muslims (intestate) | The Muslim Personal Law (Shariat) Application Act, 1937 |

But in general, the spouse, children and parents of a person are considered as his/her heirs. If you are unmarried, then your parents and siblings would be your legal heirs. Subsequently, if you get married and have children, then your spouse and children become the legal heirs.

A Nominee Is Not An Owner

Nominating someone for your asset will only give the person the right to receive the asset. But the right to own that asset can only be given through a Will.

However, in case of equity shares, the nominees win as they get what they are nominated for. Even a minor or non-relative can be appointed as nominee for your equity shares.

Let’s assume that you have a life insurance policy for which you have appointed your father as nominee. But in your Will, you would have mentioned that all your assets should be shared among your spouse and children. In that case, in the event of your death, your father may receive the amount from the insurance policy, but may end up losing it to your spouse and children. But if you have mentioned in your Will that the insurance policy amount should be given to the one you have nominated, then the nominee will be the sole owner to it.

What Happens If There’s No Will?

If a person has created a Will, then in the event of his death, his assets will be distributed based on the Will. But if there is no Will i.e., if someone dies intestate, the assets of a deceased person are distributed based on the Succession Laws such as The Hindu Law, Mohammedan Law, Indian Succession Act, etc. When a person of a different religion dies intestate, that is when the Indian Succession Act, 1925 gets applicable.

If you have made a Will, then your property will be shared to your loved ones according to your wish. Otherwise, there are chances that a person you dislike the most may get a bigger share of your property while your well wishers may get a small share or no share at all. Not only this, not having a Will may give way to many consequences, most of which are unpleasant.

In the absence of Will, the nominees may end up getting nothing. Though the nominees may initially get what the deceased person has nominated them for, but later, if any legal heir of the deceased claims his/her right on the asset passed to nominees, then the nominees would lose the asset to the legal heir. However, the result remains the same even if the demised had written a Will, but failed to mention what his nominees should get.

In order to ease the distribution of assets, make sure that your Will and nomination are on the same lines. Your Will should not lead to any kind of ambiguity. For example, if you want your son to be the owner of your investment then make him the nominee for the same. If you appoint your brother as nominee but in your Will, if you mention that your son should own it, then it may lead to conflicts in future. So, keep this in mind and make wise decisions in terms of distributing your assets. To help you out in the process of creating a Will, LegalDesk offers pre-drafted legally valid, user-friendly online Will format which surely saves a lot of your time and cost too.