Many of us come across the words “Stamp duty” or pay it in most legal matters. Truth is, not all of us are aware of its meaning or function. As we are a firm that deals with legal documents and related matters, we think it’s our job to educate our readers about the ABC’s of Stamp duty and its function.

For every legal document that you execute, you are expected to pay a certain percentage to the Government as Stamp duty.

Globally, the most accepted definition for Stamp duty is that it is a form of tax that is levied on legal documents for ensuring their validity. Which means that it is very similar to income tax or property tax that is collected by the Government.

The value of Stamp duty is either fixed or “ad valorem”, which is a legal jargon for “varies with value of property/instrument under question”.

The Legal Must-Knows Of Stamp Duty And Stamp Papers

Section 3 of the Indian Stamp Act, 1899, oversees the rules and regulations for Stamp duty payment. As it is backed by a strong law, not paying the prescribed amount or delaying the payment will attract penalty. Also, if requisite Stamp duty is not paid for a certain legal document, it shall not be considered legally valid or enforceable. Instruments and documents which are not adequately stamped are inadmissible as evidence in courts.

Levying of Stamp duty is a state subject and hence, it varies from state to state. The Indian Stamp Act, 1899, clearly stipulates that any instrument on an impressed stamp, shall be written in a manner that the stamp may appear on the face of the instrument and cannot be used for or applied to any other instrument. When it comes to adhesive stamps, it has to be cancelled to ensure that it is not used again. It will be deemed unstamped, if the adhesive stamp is not duly cancelled.

A Stamp paper that has been used once, can’t be reused for the same purpose. No corrections are allowed to be made on a document that has already been printed on Stamp paper.

Here are some more facts about Stamp duty that we want our readers to educate themselves with –

1. When To Pay Stamp Duty?

On or before the date of execution of any legal document. That’s the standard instance to pay Stamp duty to the Govt. Execution relates to the act of signing the document by the parties involved. Hence, before the signatures are placed or immediately after, the Stamp duty must be placed, but not later than that.

2. How Much Penalty Is Levied For Non-payment Of Stamp Duty?

Ranges between 2% to 200% of the deficit amount. Typically, one of the parties, involved in the legal document that has to be legalized, purchases the Stamp paper and such a paper remains valid for 6 months from the date of purchase, provided the proper Stamp duty is paid.

Common Documents On Which Stamp Duty Is Levied

In our country, there are a lot of legal documents on which Stamp duty is levied. This usually includes –

- Rental Agreements

- Shares

- Debentures

- Transfer of property

- Promissory notes

- Papers relating to movable and immovable assets

- Affidavits

- Gift deeds

- Sale agreements

- Bank guarantees

- Leases

- Papers relating to loans

- Papers relating to real estate transactions

Please note, these are just a few examples. A lot more documents require the payment of Stamp duty. To prevent an overload of information, we’ve just listed the major ones here.

Types Of Stamps And Stamp Papers Used In India

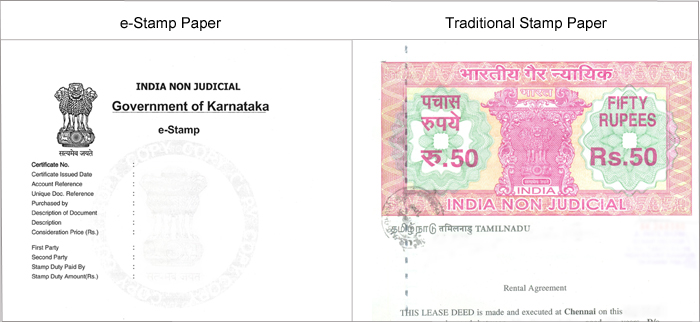

Broadly, there are two types of stamps in use in our country. They are-

- Impressed Stamps

- Adhesive Stamps

Impressed stamps include labels that are affixed/ impressed by an officer. It could also be a stamp that is embossed or engraved on Stamp paper. And finally, they could be impressions left by Franking machines, which is generally done at banks.

Adhesive stamps, as the name suggests are convenient labels that are simply stuck on instruments/documents. They are further classified as postal and non-postal stamps. For documents, impressed stamps are the ones in common use.

Ways To Pay Stamp Duty

Stamp duty is paid through the purchase of Stamp paper. The way you purchase Stamp paper varies from state to state in India. In few states, the very convenient e-Stamping system is in place while in some other states, the traditional impressed non-judicial Stamp papers are to be purchased from Stamp vendors. In Maharashtra, Stamp duty can be paid online through the Govt. of MH website. And then finally, there is Franking, which involves you submitting an application at an authorized agency or a bank. You will attach the document you wish to Stamp duty for and the agency/bank affixes a stamp on it indicating that the requisite duty has been paid.

For your reference, here’s a table of differences between Judicial and Non-Judicial Stamp paper-

| Judicial Stamp Paper |

Non-Judicial Stamp Paper |

| Used in courts for purposes like payment of court fees, also known as court fee Stamp paper | Used for execution of legal documents |

| Used in activities relating with administration of justice | Used in documents like agreements, transactions related to real estate, power of attorneys etc |

| Stamp duty paid for Judicial Stamp Paper is paid under the Court Fees Act, 1870 | Stamp duty for Non-Judicial Stamp Paper is paid under The Indian Stamp Act, 1899 |

Avail Documents Printed On Stamp Paper With LegalDesk

If you are in need of a legally valid and enforceable document or instrument, proceeding in the conventional way can take up a lot of your time. This is why LegalDesk exists. We can let you create legal documents online from the comforts of your home, have it printed on Stamp paper of recommended value and get it delivered to your doorstep. All you need to do is pick which document you want to create, from our preset list, and fill in your details. All forms and documents available with us are verified by our in-house legal experts and are hence, guaranteed to give you the protection you deserve.

We also have a new feature Print ‘n’ Deliver, which lets you upload your already prepared documents to just have them printed on Stamp paper and delivered to an address of your choice. This means that, if you have a document ready and all you need is to get it printed on Stamp paper, you can use our Print n’ Deliver service for it. Go ahead, give our legal documents a try!